As part of EU-wide reforms to VAT and customs processes, new rules and regulations are being gradually introduced that will change how e-commerce businesses declare and pay VAT, submit tax and customs information, and the duties and fees required.

These changes are designed to reduce fraud and make the entire customs process faster, easier and safer for both retailers, customers and customs officials. In July 2021, the EU will introduce the Import One-Stop Shop, or IOSS, and remove the low-value consignment relief of €22.

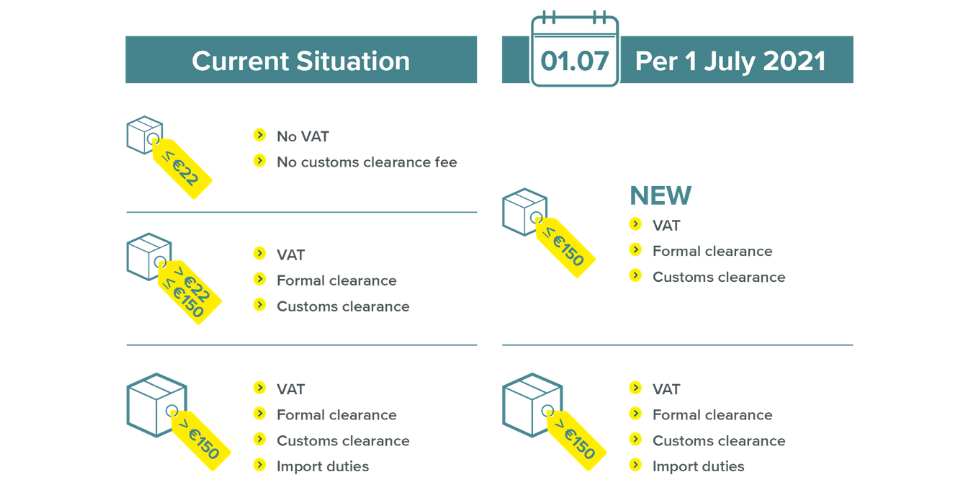

- Abolition of low-consignment relief

The low-consignment relief was intended to save customs officials time when checking parcels and packages, but in fact left many EU retailers at a disadvantage as they had to pay VAT on EU-bound goods. The new rules will make VAT payments fairer for everyone.

The new VAT rules will affect B2C consignments of standard goods (goods not subject to excise duties such as alcohol) imported into the EU and valued at €150 or less. The existing threshold for distance sales of goods within the EU will be replaced with a new, EU-wide threshold of €10,000.

- IOSS

The Import-One Stop Shop (IOSS) scheme is based on an electronic portal through which online retailers can declare and pay VAT.

It will mean VAT charges are clearly displayed for customers and also means buyers are only charged once, at the time of purchase, so there are never any hidden fees for e-commerce customers.

IOSS registration is not compulsory, but can make VAT payment processes easier and simpler. Registration is open from April 1st, but the IOSS will not be implemented until July 1st.

- Marketplaces

For e-commerce retailers selling through marketplaces, the new rules mean the platform facilitating e-commerce sales will be responsible for charging and collecting VAT as of July 1st, acting as the deemed supplier for low-value consignments.

- Supporting e-commerce businesses

Asendia is working hard to prepare for the changes, adapting our shipping systems and enhancing our services and data processes ready for July 1, 2021.

To make sure there are no delays for our customers, we are providing customs pre-paid and customs paid at destination solutions (whether you register for IOSS or not), support with submitting Electronic Advance Data and IOSS intermediary recommendations. We are also developing add-ons and web portals to ensure a seamless transition for Asendia customers, and will be keeping you up to date with the latest rules and regulations throughout the year. For more information about IOSS and the new VAT rules, visit our dedicated webpage.